Table Of Contents

- Understanding Pollution Liability Insurance

- Tailored Insurance Solutions For Las Vegas Businesses

- What’s Covered Under Pollution Liability Insurance In Las Vegas

- Businesses That Benefit From Pollution Liability Coverage

- Our Clients' Testimonials

- Patrick O’Neill & His Experienced Coverage Team

- Why We’re Las Vegas’s Leading Pollution Liability Brokers

- Start Your Pollution Liability Policy Today

- Visit Our Conveniently Located Insurance Office In Las Vegas

- FAQs About Pollution Liability Insurance

- Read Our Blog To Learn More About Insurance & Liability

- Build A Coverage Plan That Works For You!

Understanding Pollution

Liability Insurance

Flexible Insurance Options For Businesses Of Every Size

Many businesses in Las Vegas face environmental risks that vary by industry, so flexible insurance choices are crucial to help them stay protected. At PJO Insurance Brokerage, we support companies with coverage that fits their operations, project size, and regulatory exposure. These options guard against unexpected pollution events and keep organizations ready to handle claims, cleanup needs, or contract requirements confidently.

From small contractors to large industrial operations, pollution liability protection in Las Vegas is essential to protect companies from many daily exposures. With our insurance services, we guide clients through available options, explain coverage limits, and help them secure policies that support compliance. These solutions strengthen long-term stability and give businesses confidence when navigating strict environmental rules or addressing accidental contamination issues. Our strong guidance ensures clear decisions and safeguards business growth.

Tailored Insurance Solutions For Las Vegas Businesses

Starting Out Or Scaling Up? We’re With You At Every Step

What’s Covered

Under Pollution Liability Insurance In Las Vegas

Businesses That Benefit From Pollution Liability Coverage

Manufacturing Companies Using Chemicals

Manufacturers that handle chemicals face constant exposure to spills, leaks, and regulatory issues. Pollution liability insurance helps them manage cleanup duties, legal expenses, and third-party claims while keeping production stable and compliant.

Waste Management Companies

Waste facilities deal with materials that can contaminate soil, air, or groundwater. This coverage supports responsible handling, unexpected release response, and regulatory protection. It also strengthens operations by safeguarding against costly claims.

Construction & Demolition Contractors

Contractors disturb soil, transport materials, and manage debris, increasing the risk of environmental harm. Pollution liability coverage addresses accidental releases, contamination issues, and legal claims. It helps teams work confidently while meeting project requirements and industry regulations.

Transporters Of Hazardous Materials

Transport companies face significant risk when moving hazardous loads. A single spill can trigger cleanup expenses, property damage, and legal claims. Pollution liability insurance protects drivers and businesses by covering incidents that occur during transit.

Industrial Cleaning & Maintenance Providers

Cleaning crews handle solvents, chemicals, and waste that can create contamination issues. This coverage supports them when spills occur, waste is mismanaged, or third-party property suffers damage. It strengthens regulatory compliance and helps maintain safe, efficient service operations.

Protect Your Business With The Right Insurance Coverage

Contact Patrick O’Neill

Our Clients’ Testimonials

5-Star Rated Pollution Liability Insurance Provider In Las Vegas

PJO Insurance Brokerage has a comprehensive understanding of all your insurance needs! Not only are they highly knowledgeable, they also offer a level of professionalism and courtesy that set them apart from their competition. Quick to respond to your needs, PJO Insurance Brokerage makes you feel like you have someone looking out for your best interests. Our company has used them exclusively and will contiue to do so. We have the upmost confidence in PJO Insurance Brokerage, and so should you!

Felicity Sevanik | ★★★★★

Patrick is the easiest person to work with and always gets our company the best possible insurance rates. We love working with PJO Insurance Brokerage!

Melissa Mcmurray | ★★★★★

Great Insurance agency, I’ve been with PJO Insurance for many years insuring all my business needs, they always get me the best deals possible, very professional and trust worthy.

JJ Property Investments LLC | ★★★★★

Patrick O’Neill & His Experienced Coverage Team

Trusted Brokerage Insurance Company With 50 Years Of Proven Experience

Patrick O’Neill leads a skilled team focused on helping businesses secure strong protection against environmental risks. We provide clear guidance, reliable insight, and experienced support for companies facing exposure to pollution events across Las Vegas. Each policy review highlights real-world concerns and offers practical solutions that protect operations. Our team works closely with clients to deliver dependable coverage built for long-term stability and business growth.

At PJO Insurance Brokerage , we help companies understand their risks, compare coverage options, and secure reliable protection.

Why We’re Las Vegas’s Leading Pollution Liability Brokers

Comprehensive Environmental Risk Assessments

We evaluate each business carefully and identify real exposures that impact daily operations. These assessments help clients understand risks, strengthen compliance, and select policies that offer meaningful environmental protection.

Customized Pollution Liability Coverage Plans

We design clear insurance plans that address specific environmental needs. Each option helps businesses manage spills, contamination concerns, and liability claims while maintaining regulatory compliance and financial security across Las Vegas.

Ongoing Policy Reviews & Coverage Optimization

We review policies regularly to ensure coverage evolves with changing operations. These updates keep protection relevant, strengthen risk management, and help businesses avoid costly gaps as they grow and adapt within the local market.

Responsive Support For Environmental Claims

We assist clients immediately when environmental claims arise. Fast guidance helps them manage cleanup duties, legal demands, and regulatory communication while protecting financial health and maintaining operational stability.

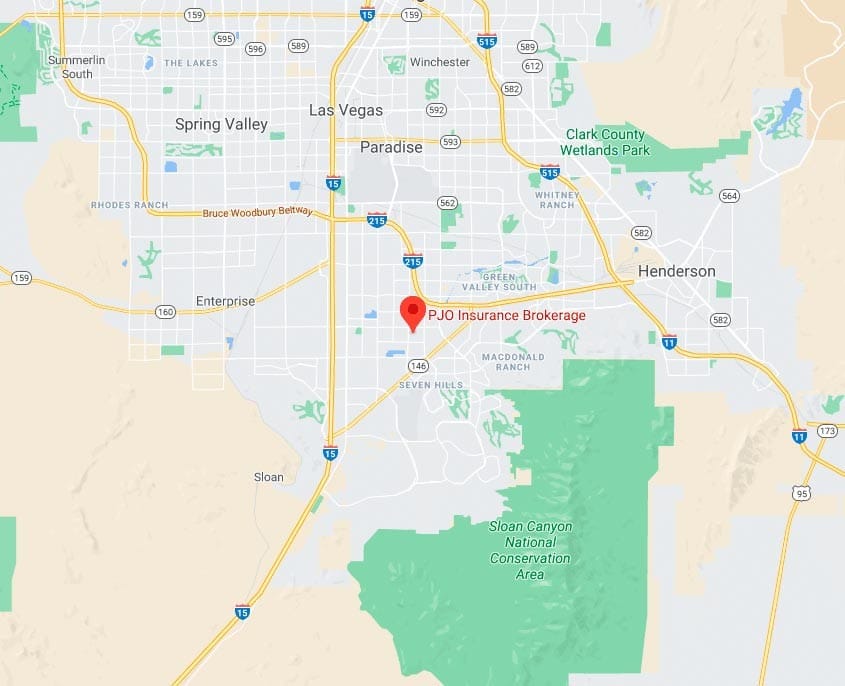

Visit Our Conveniently Located Insurance Office In Las Vegas

9850 S Maryland Parkway #5, Las Vegas, NV 89183

Monday – Friday: 9:00 am – 5:00 pm

Saturday: 9:00 am – 12:00 pm

FAQs About Pollution Liability Insurance

Read Our Blog

To Learn More About Insurance & Liability

Top Reasons Your Startup Should Invest In Product Liability Insurance

Learn How Product Liability Insurance Protects Your Startup From [...]

What Types Of Property Damage Are Covered Under Commercial Property Insurance?

Choosing The Right Commercial Property Insurance: Tips & Expert [...]