Table Of Contents

- Protect Your Business In Garden Grove With Reliable Insurance Coverage

- Personalized Insurance Solutions For Your Garden Grove Business

- Your Local Partner For Business Insurance In Garden Grove, CA

- Our Clients’ Testimonials

- Meet Patrick O’Neill & His Dedicated Team

- The Essential Insurance Policies For Garden Grove Companies

- Ensure Your Business’s Future With The Right Insurance

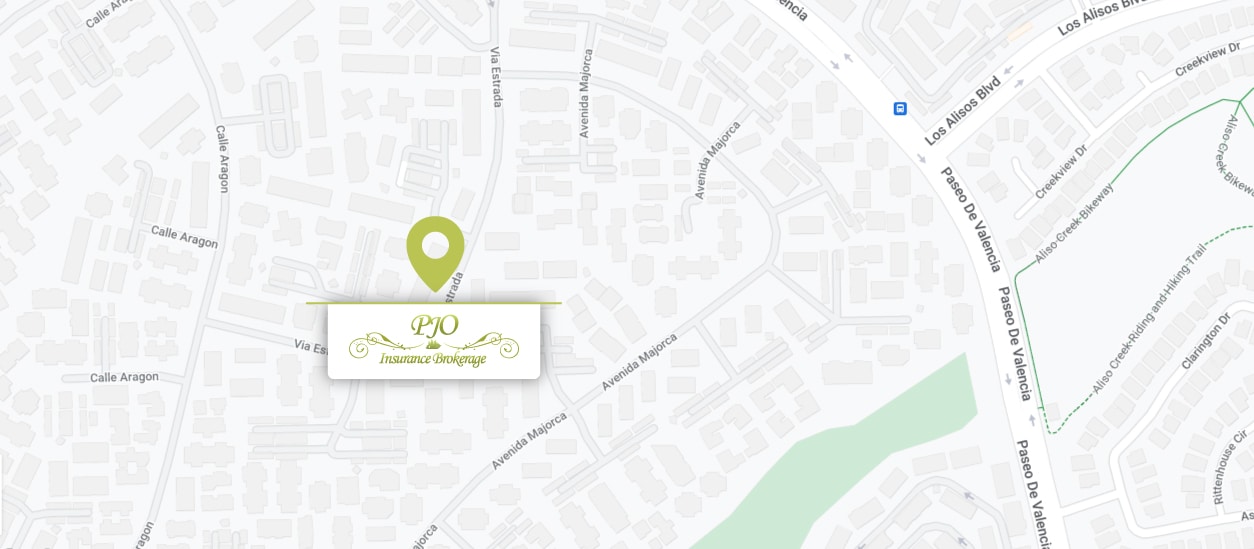

- Our Business Insurance Office Is Conveniently Located Near Garden Grove

- FAQs About Business Insurance Brokers

- Read Our Blog & Learn More About Business Insurance & Liabilities

- Looking For The Right Insurance? Get A Free Quote & Assistance!

Protect Your Business In Garden Grove With Reliable Insurance Coverage

Commercial Insurance Brokers For Every Stage Of Business Growth

At PJO Insurance Brokerage, we are proud of helping businesses in Garden Grove protect what they’ve worked hard to build through reliable, well-structured insurance coverage. Every business faces different risks depending on its size, industry, and stage of growth, which is why we focus on understanding operations before recommending coverage.

Our role as California business insurance brokers is to simplify complex policies, identify potential gaps, and secure protection that supports both daily operations and long-term goals.

As businesses evolve, insurance needs change. We work with startups, growing companies, and established organizations, adjusting coverage as teams expand, revenue increases, or regulations shift. From liability protection to industry-specific policies, we compare options from trusted carriers to deliver cost-effective solutions without unnecessary extras. We firmly believe that business insurance should be proactive, not reactive. By reviewing coverage regularly and planning efficiently, we help reduce exposure to financial loss, claims disputes, and unexpected interruptions, giving business owners confidence and clarity.

Personalized Insurance Solutions For Your Garden Grove Business

Offering A Broad Range Of Business Insurance Coverage

Your Local Partner For Business Insurance In Garden Grove, CA

Proudly Supporting Garden Grove Businesses For 20+ Years

For more than two decades, we’ve worked with local companies in Garden Grove to help them grow successfully. We understand the unique risks and regulations that impact local industries, which is why many companies trust our local insights, as we ensure the best insurance strategies that align with regional requirements, industry standards, and everyday business realities, creating dependable protection rooted in experience.

We value long-term relationships built on trust, transparency, and responsiveness. By staying accessible and proactive, we help business owners make informed decisions, address coverage gaps, and navigate claims with confidence, knowing their insurance partner is invested in their success.

Our Clients’ Testimonials

5-Star Rated Commercial Insurance Experts Serving Garden Grove

PJO Insurance Brokerage has a comprehensive understanding of all your insurance needs! Not only are they highly knowledgeable, they also offer a level of professionalism and courtesy that set them apart from their competition. Quick to respond to your needs, PJO Insurance Brokerage makes you feel like you have someone looking out for your best interests. Our company has used them exclusively and will contiue to do so. We have the upmost confidence in PJO Insurance Brokerage, and so should you!

Felicity Sevanik | ★★★★★

Patrick is the easiest person to work with and always gets our company the best possible insurance rates. We love working with PJO Insurance Brokerage!

Melissa Mcmurray | ★★★★★

Great Insurance agency, I’ve been with PJO Insurance for many years insuring all my business needs, they always get me the best deals possible, very professional and trust worthy.

JJ Property Investments LLC | ★★★★★

Meet Patrick O’Neill & His Dedicated Team

Over 50 Years Of Combined Experience In California Business Insurance

With over 50 years of combined experience, Patrick O’Neill and his expert team offer expert knowledge and industry expertise in business insurance. We are dedicated to providing insurance solutions and the highest quality service tailored to your business needs. Our commitment is to build enduring client relationships, offering reliable guidance and support throughout your journey.

Our team is passionate about helping businesses thrive. We work closely with you to understand your needs, offering personalized advice and strategies to protect your assets. Our expert approach means you get more than just insurance; you get a partner dedicated to your business’s success. Trust Patrick O’Neill and his team to be your allies in navigating the insurance landscape, ensuring your business is secure and prosperous.

The Essential Insurance Policies For Garden Grove Companies

Specialized Commercial General Liability Coverage Near Garden Grove, CA

PJO Insurance Brokerage offers essential business insurance in Garden Grove, CA, focusing on protecting companies from daily operational risks. One of our focuses in this protection is commercial general liability coverage, as it’s a crucial element for safeguarding businesses against third-party claims involving bodily injury, property damage, and the associated legal expenses.

We work strategically with each client, carefully evaluating their specific operations to recommend appropriate policy limits and endorsements tailored to their industry exposure. By building customized coverage, we help businesses maintain compliance, significantly reduce financial vulnerability, and operate with confidence. This ensures they are protected against unexpected claims that can disrupt their growth.

Our Business Insurance Office Is Conveniently Located Near Garden Grove

107 Via Estrada, Unit A

Laguna Woods, California 92637

Monday – Friday: 9:00 am – 5:00 pm

Saturday: 9:00 am – 12:00 pm